As you transition from one living space to another, several variables should factor into your decision. Good location, a short commute to work and comfortable accommodations are all essential — but none of these qualities matter if you can’t find money in your budget to afford them.

Before the time-consuming challenge of apartment hunting begins, lay the foundation by calculating how much rent you can afford. It’s disheartening to find the place of your dreams only to realize you can’t pay for the nightmarish cost of living there. In this article, we’ll offer formulas and advice to help you on your way.

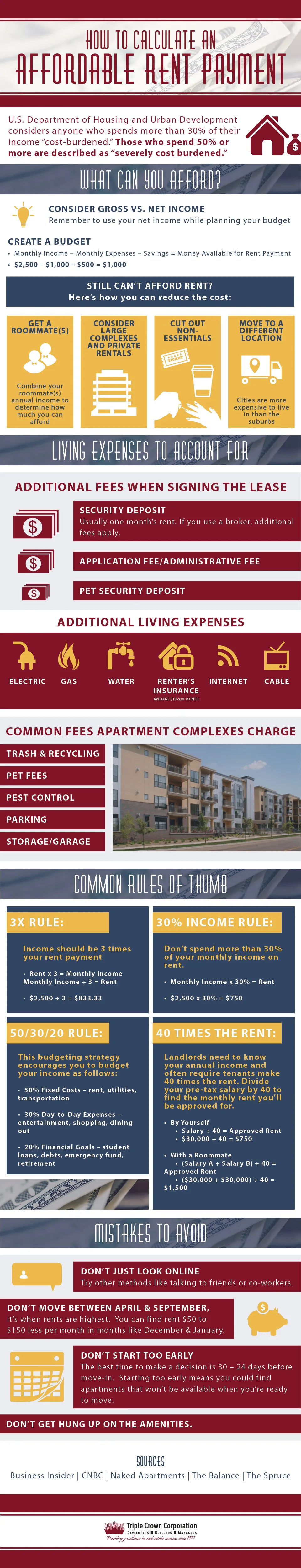

Check out the micrographic below for a comprehensive list of what to expect and account for as you begin to crunch the numbers.

This micrographic will lead you in the right direction, but there’s more you need to know! Keeping a roof over your head is important business that shouldn’t be taken lightly, so invest yourself in thorough research before you make your decision to avoid any unwanted consequences — eviction, for example.

Here are some additional tips to ease the process and simplify your budgeting.

Consider middle floor units in the building you’re interested in. Unlike top floor apartments with beautiful views or bottom floor apartments with easy accessibility, middle floor apartments are comparatively inexpensive to adjust for reduced demand. Rent payments for these units are easier to afford.

You won’t enjoy the city skyline or the convenience of a closer unit, but you’ll save a significant sum of money in the long run. As long as physical mobility doesn’t present an issue, the middle floor is the smartest option for those seeking to capitalize on less popular space.

Are you a handy person with a DIY attitude? If so, investing in a fixer-upper apartment can earn you substantial savings on rent payments. While a portion of these savings will go toward any improvements you make, repairing the wear and tear in a unit is an ultimately profitable endeavor.

That said, all of this depends on a successful negotiation with the landlord. If you can convince them to allow you to work on a unit, they might agree to lower your monthly rate. If you decide on this alternative, add the cost of supplies to your list of other expenses.

Your pet might get sick and need a costly treatment. You might sustain an injury that your medical insurance doesn’t completely cover. A hundred different setbacks can leave you high and dry and short on cash, stuck between buying groceries for the week and affording rent for the month.

Put a small percentage of your income toward growing an emergency fund. Week by week, take any money you didn’t spend on necessities and place it in a savings account. When an emergency inevitably happens — and it will — you’ll have prepared for it and won’t have to make any painful sacrifices.

Through the clever application of certain techniques, you can save extra money to add to your monthly rent budget. This will open up new opportunities and afford you a higher degree of flexibility in your search, so you don’t have to settle for a basement apartment in a bad neighborhood.

Of all the strategies available to you, couponing is among the most common. The dollars and cents you scrounge from coupon clipping may not seem like much at first, but the savings will add up quickly. It’s a little extra work, but the benefits are well worth the effort.

Budgeting isn’t a simple task. There are dozens of factors that can overwhelm someone unaccustomed to independent living. Accounting for the rent to income ratio, consideration of secondary expenses and the looming responsibility of unrelated payments can make anyone panic.

But a clear understanding of the math behind the monster will alleviate your stress. The worry is unnecessary. Just take your budgeting one step at a time, and you’ll find that the question of, “How much rent can I afford?” has an easy answer.